Paying Taxes in the UK: Simple Guide to HMRC, NI & More

New to the UK or just need a clear explainer on paying taxes in the UK? This plain‑English guide shows you how HMRC, National Insurance and deadlines fit together—so you avoid costly mistakes and feel confident in your first year.

We will cover the UK tax year, National Insurance, PAYE vs Self Assessment, newcomer tips, current rates sources, how to pay (and appeal penalties), smart tax moves, and quick resources. You will also see how the Life in the UK Test App helps you remember HMRC and NI facts for the exam—fast.

Start here: paying taxes in the UK made simple

In the UK, most employees pay Income Tax and National Insurance (NI) through their employer’s payroll under PAYE. If you are self‑employed or have extra untaxed income, you usually file a Self Assessment tax return and pay HMRC directly.

HMRC is the UK’s tax authority. It runs PAYE, collects Self Assessment, and manages NI records.

Personal Tax Account: your secure online account to check tax codes, request refunds and update details.

UK tax year: runs from 6 April to 5 April the following year—deadlines hinge on these dates.

What HMRC does and why it matters

Definition: HMRC (His Majesty’s Revenue and Customs) administers taxes and National Insurance, pays certain benefits, and enforces compliance.

Employees: HMRC issues your tax code to your employer, who deducts tax/NI before you are paid.

Self‑employed: you register, file returns, and pay Income Tax and NI directly to HMRC.

Compliance and support: HMRC provides guidance, helplines and the HMRC app, and can investigate errors or fraud.

The UK tax year and key dates you must know

Tax year: 6 April to 5 April.

Self Assessment deadlines: paper returns usually by 31 October; online returns and first payment by 31 January; second payment on account by 31 July.

PAYE: tax is deducted every payday; you will receive year‑end forms like a P60 from your employer.

Keep an eye on your Personal Tax Account for notices or refunds.

National Insurance explained: what, why, and how

National Insurance (NI) is a contribution system that helps fund the State Pension and certain benefits. Employees and the self‑employed pay NI when earnings exceed set thresholds.

Your NI number: how to get it and when you need it

Apply for an NI number if you do not have one: use the official NI number application.

Give your NI number to your employer so your tax and NI are recorded correctly with HMRC.

Link it to your Personal Tax Account to view NI contributions and credits.

NI classes and rates: employees vs self‑employed

Employees: usually pay Class 1 NI via payroll when earnings pass weekly or monthly thresholds; employers also contribute.

Self‑employed: typically deal with Class 2 (for State Pension entitlement) and Class 4 (on profits). Recent changes affect Class 2 obligations—check the latest rules before filing.

See current thresholds and categories on How much NI you pay and NI letters.

What NI funds: State Pension, benefits, and credits

State Pension: your NI record builds qualifying years. Learn how it is calculated on GOV.UK.

Statutory pay: NI and earnings records determine eligibility for payments such as Statutory Maternity Pay.

NI credits: you may receive credits during periods like childcare or illness. See NI credits.

Income Tax under PAYE: employees and starter basics

Under PAYE, your employer uses your tax code to calculate Income Tax and NI each payday. Check your payslips and tax code to avoid under‑ or overpaying.

Tax codes decoded (1257L, BR, 0T, D0, NT)

1257L: the standard code for most people getting the full Personal Allowance in the rest of the UK; Scottish codes start with an "S".

BR: basic rate on all income from that job (often used for second jobs until records update).

0T: no Personal Allowance is applied (often an emergency code).

D0/D1: all income taxed at higher/additional rate for that job.

NT: no tax taken (very specific scenarios).

If your code looks wrong, update details and view your notices via HMRC’s tax code guidance or your Personal Tax Account, and contact HMRC if needed.

Your forms: P45, P60, P11D and the Starter Checklist

P45: given when you leave a job; hand it to your new employer to avoid emergency tax.

P60: annual summary from your employer after the tax year ends.

P11D: shows taxable benefits if they are not payrolled; check it for accuracy.

Starter Checklist: used by your employer if you have no P45 (e.g., first UK job). Keep copies for your records.

Overpayments, refunds, and how to claim

Common causes include changing jobs, being on the wrong tax code, or working part‑year.

Sign in to your Personal Tax Account.

Check your tax code and year‑to‑date pay and tax.

Use HMRC’s online service to claim a refund, or your employer may correct it in the next payroll.

Keep P45/P60/P11D and payslips to support your claim.

Allow processing time; refunds are usually paid directly to your bank.

Self Assessment: freelancers, contractors, and side‑hustles

If you are self‑employed or have untaxed income (e.g., rental, foreign dividends, or side‑hustle income), you may need to file a Self Assessment tax return.

Registering with HMRC and deadlines

Register online for Self Assessment: register with HMRC. You will receive a UTR (Unique Taxpayer Reference).

Key dates: paper returns by 31 October; online returns by 31 January; pay by 31 January (and 31 July for payments on account).

See official Self Assessment deadlines.

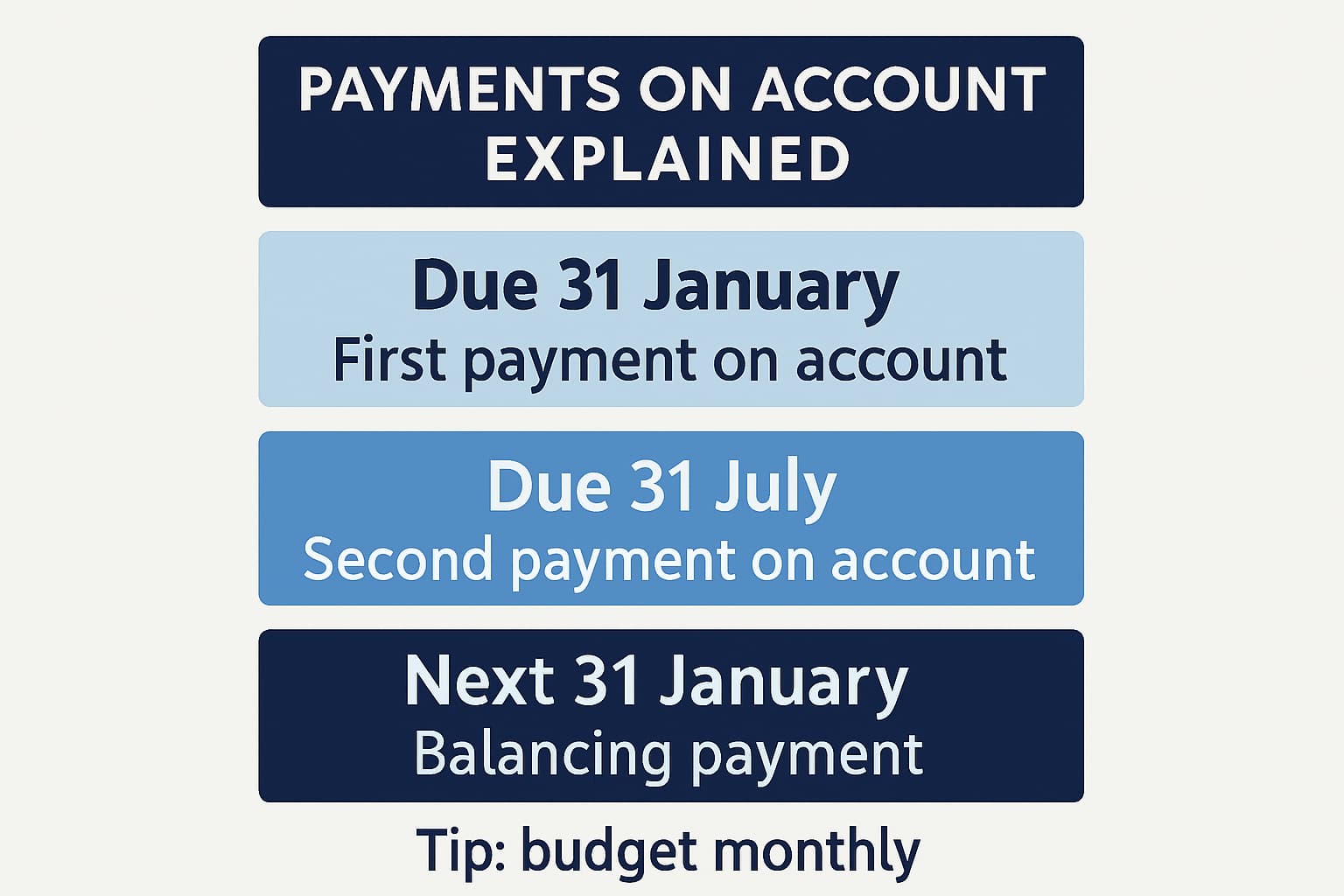

Payments on account and balancing payments

Payments on account spread the cost of next year’s tax if a significant amount was due this year (normally when less than most tax is collected at source and your bill is over a set threshold).

You usually make two advance payments (January and July), then a balancing payment the following January.

If your income falls, you can ask HMRC to reduce payments on account.

Budget monthly to avoid cash‑flow crunches.

Allowable expenses and basic record‑keeping

Claim only costs wholly and exclusively for your business: travel, home office proportion, software, professional fees.

Keep digital copies of receipts and invoices; note mileage and dates.

Read HMRC’s guide to allowable expenses.

Class 2 and Class 4 NI for the self‑employed

Class 2 affects State Pension entitlement; Class 4 is based on annual profits.

Rules and thresholds can change—check current Self Assessment guidance and NI pages before you file.

Start at National Insurance on GOV.UK.

New to the UK? Paying taxes in the UK as a newcomer

Arriving mid‑year, taking your first job, or juggling multiple roles? Here is what to watch.

Arriving mid‑year, residence, and split‑year basics

UK tax residence drives what income is taxed. Read HMRC’s residence guidance and split‑year treatment overview.

Start with UK residence and split year.

Keep travel dates, visa status and overseas income records from day one.

Working two jobs or changing jobs

Give your P45 to your new employer. Without it, complete the Starter Checklist.

Only one job should use your Personal Allowance; the other may be on BR until HMRC updates records.

Check codes in your Personal Tax Account to avoid double‑tax and correct NI category letter.

Overseas income, double taxation treaties, and remittances

Declare overseas income if you are UK tax resident (subject to domicile and remittance rules).

Check relief under double tax treaties and keep evidence of foreign tax paid.

See Tax on foreign income and, if relevant, non‑domiciled remittance rules.

Rates and thresholds for 2025/26: what to check

Rates can change each tax year and differ in Scotland. Instead of memorising numbers, bookmark the official sources below and verify before you file or plan.

Income Tax bands and allowances (rUK vs Scotland)

Scotland sets its own Income Tax rates and bands for Scottish taxpayers on employment, pension and most non‑savings income. The rest of the UK (England, Wales and Northern Ireland) follows UK‑wide rates.

Area | Bands structure | Who sets rates | Notes |

|---|---|---|---|

Rest of UK (rUK) | Personal Allowance, basic, higher, additional | UK Parliament | Applies to savings and dividends across the UK |

Scotland | Multiple bands; thresholds and rates can differ | Scottish Parliament | Identified by tax codes starting with "S" |

National Insurance thresholds and categories

Check current NI thresholds, categories and letters before running payroll or filing returns.

NI thresholds and examples: How much you pay

NI letters and categories (A, B, C, H, J, M, Z, etc.): NI rates and letters

Where to find the latest official rates

Income Tax and NI overview: GOV.UK tax

Scottish Income Tax policy: Scottish Government Income Tax

HMRC app for live info and secure payments: Get the HMRC app

How to pay: methods, deadlines, penalties, and appeals

Most employees pay through PAYE automatically. If you file Self Assessment, plan ahead for deadlines and choose a payment method with enough processing time.

PAYE vs Self Assessment deadlines you cannot miss

PAYE: tax is deducted on payday; employers report monthly in real time.

Self Assessment: 31 January (online filing and first payment) and 31 July (second payment on account) are the big dates.

See official deadline guidance.

Ways to pay: bank transfer, Direct Debit, card, HMRC app

Faster Payments/bank transfer (fastest), CHAPS, or BACS (slower).

Debit/credit card online, or set up Direct Debit in your Personal Tax Account.

Use the HMRC app to see what you owe and pay securely.

Late filing penalties, interest, and reasonable excuse

Penalties and interest apply if you miss deadlines. If something outside your control caused the delay, you may appeal with a reasonable excuse.

Check current penalty stages and interest rules: Self Assessment penalties.

How HMRC views a reasonable excuse and how to appeal.

Smart tax moves: reliefs and allowances to know

Within the rules, you can legally reduce Income Tax and NI—especially through pensions and workplace schemes.

Pension contributions, salary sacrifice, and NI savings

Boost workplace or personal pension contributions to reduce taxable income.

Use salary sacrifice for pensions, cycle‑to‑work or other approved benefits to save NI too.

Always check employer policies and your scheme limits.

Gift Aid, Marriage Allowance, and Blind Person’s Allowance

Gift Aid lets charities claim extra from HMRC; higher‑rate taxpayers can claim additional relief.

Marriage Allowance lets one spouse/civil partner transfer a portion of their allowance to the other (if eligible).

Blind Person’s Allowance gives an extra tax‑free amount if you qualify.

Student loans, Child Benefit charge, and ISAs

Student loan repayments are based on income thresholds; see what you pay.

Beware the High Income Child Benefit Charge if your income crosses the relevant level.

Use ISAs to keep interest, dividends and gains tax‑free within annual limits.

Stay safe and compliant: records, scams, and support

Good records, scam awareness, and timely help are your best protection.

What records to keep and for how long

Self‑employed: keep business records and receipts for at least 5 years after the 31 January submission deadline.

Employees: keep P60, P45, P11D and payslips for several years to support refunds or mortgage checks.

See HMRC’s guidance on how long to keep records.

Spotting scams: how HMRC will and will not contact you

HMRC will not threaten arrest or demand payment via gift cards or cryptocurrency.

Be cautious with texts/emails containing links. Verify at HMRC phishing and scams.

Access your Personal Tax Account directly via GOV.UK, not from unsolicited links.

Where to get help: HMRC, free advice, and tools

HMRC helplines and webchat: Contact HMRC

Free guidance: Citizens Advice and TaxAid (for low‑income taxpayers)

HMRC app for secure access and payments: download the HMRC app

Ace the Life in the UK Test: HMRC and NI facts you will face

The Life in the UK Test checks basic knowledge of HMRC, the UK tax year, and National Insurance. Memorising the essentials saves time and stress.

Must‑know exam points on taxes and National Insurance

Who is HMRC? The government department responsible for collecting taxes and NI, and enforcing compliance.

UK tax year dates: 6 April to 5 April.

What is National Insurance? Contributions by workers and employers that help fund the State Pension and certain benefits.

Tax codes: how PAYE collects tax; Scottish codes start with "S".

How the Life in the UK Test App speeds up your learning

If you feel overwhelmed by the handbook, the Life in the UK Test App keeps you on track:

Smart assistant Brit‑Bear prioritises what to study next so you do not waste time.

Readiness score shows when you are truly exam‑ready.

650+ questions with explanations plus mock tests, including a Hard Mode to simulate the real exam.

Offline access lets you learn anywhere.

Get the app: links and next steps

Start targeted practice today and master HMRC and NI facts faster:

Download on App Store: iOS download

Get it on Google Play: Android download

Quick checklist and trusted resources

5‑minute newcomer checklist

Apply for your NI number (if you do not have one).

Set up and check your Personal Tax Account details and tax code.

Give your P45 to your new employer or complete the Starter Checklist.

Register for Self Assessment if you have self‑employed or untaxed income.

Note deadlines: 31 January and 31 July; set calendar reminders.

Download the HMRC app for quick checks and payments.

Prep for the citizenship test with the Life in the UK Test App on iOS or Android.

Official links and further reading

HMRC overview: Taxes on GOV.UK

Tax codes: Tax code guidance

Self Assessment: Self Assessment hub

National Insurance: NI guidance

Scottish Income Tax: Scotland official

Foreign income: Double taxation and relief

FAQ

Do I need to register for Self Assessment if I am an employee?

Only if you have untaxed income (self‑employment, rental, foreign income, large savings dividends) or HMRC tells you to file.

What if I start work without an NI number?

You can start a job, but apply for an NI number promptly and give it to your employer when received.

How do I fix an incorrect tax code?

Update your details in your Personal Tax Account and review HMRC tax code guidance; your employer will receive updates.

When do payments on account apply?

Generally when your last bill is over a threshold and you have too little tax collected at source. See HMRC’s payments on account page.

Where can I see what I owe and pay quickly?

Use the HMRC app or your Personal Tax Account; both support secure payments and show deadlines.